Be Long-Term Greedy When it Comes to GTM

In an uncertain economy, customers can be more reluctant to commit significant resources to a new software purchase. Therefore, it’s not surprising that many of our portfolio companies have expressed to us that procurement processes are facing more scrutiny and that it’s taking longer to sign deals.

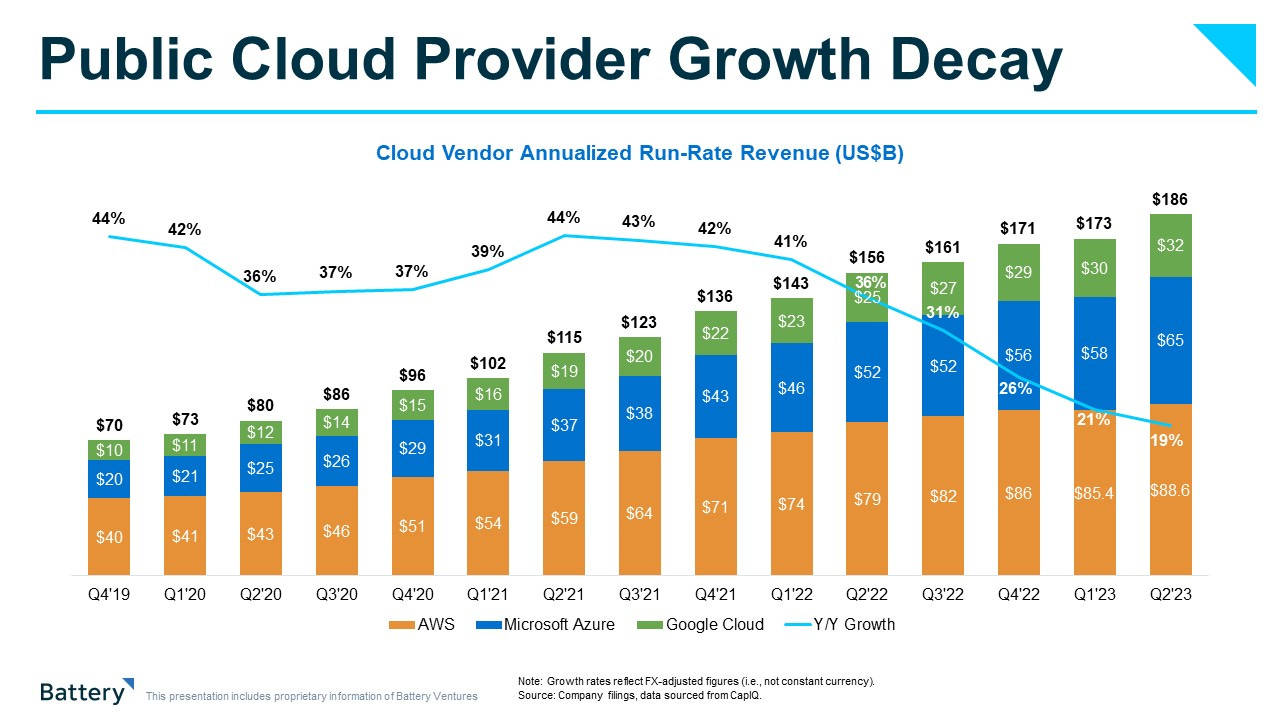

Rising interest rates, geopolitical tensions and high inflation are all factors increasing pressure on go-to-market (GTM) teams. To contextualize the growth tension that we’re seeing across the broader software market, just look at the recent trends in revenue growth for the large public cloud-computing providers (below). Combined growth has decayed from roughly 40% in 2021 to 19% in the most recent quarter. Pain is being felt across the board as budget reductions and longer deal cycles make renewals, expansions and new customer lands more challenging.

But for companies trying to build repeatability and scale growth today, there’s one simple strategy that we think GTM teams often overlook. This strategy, in our view, can help your company to weather the current storm and help set you up for long-term success.

It’s this: Focus on “logo velocity,” which we define as the speed, frequency and repeatability of acquiring new customers.

While nothing feels better than closing a large contract, landing a larger number of new customers can actually be more strategic, especially in the current environment.

Focusing on logo velocity offers a few key benefits:

- First, it fosters predictability and consistency. Smaller deals typically have a less onerous procurement process and are faster to close (even more true in challenging economic times when there is more budget scrutiny and procurement complexity). By reorienting your sales team around logo velocity, you’ll add much-needed predictability and consistency to your sales process instead of relying on one or two key large deals each quarter to hit plan.

- Second–and this is especially true for early and mid-stage companies–you’ll get more GTM repetition and better customer insights. Your GTM team will get more comfortable closing deals, and your product team will get valuable customer insights and product feedback by virtue of having more users on the platform, not a smaller number of customers who signed up for big deals. This feedback loop will help drive GTM and product improvements.

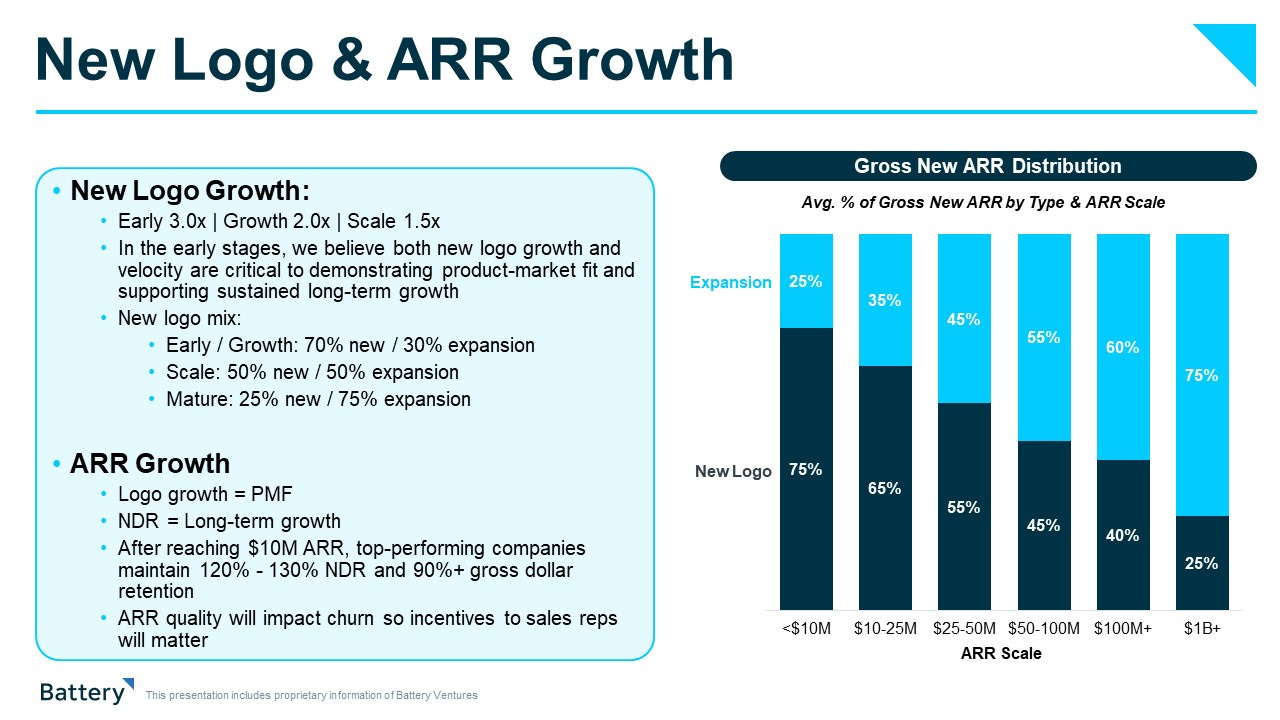

- Finally, you’ll build a strong foundation to drive long-term, durable growth. While new logos tend to fuel growth for early-stage companies, expansion becomes more important as companies mature. You can expect expansion to represent ~50%+ of annual recurring revenue (ARR) over time, as illustrated in the chart below. Signing a larger number of quality customers today, even at lower entry annual contract values (ACVs), allows you to build a strong foundation of customers that will ultimately seed future expansion and drive long-term growth.

Here are three key pointers to executing this logo-velocity playbook:

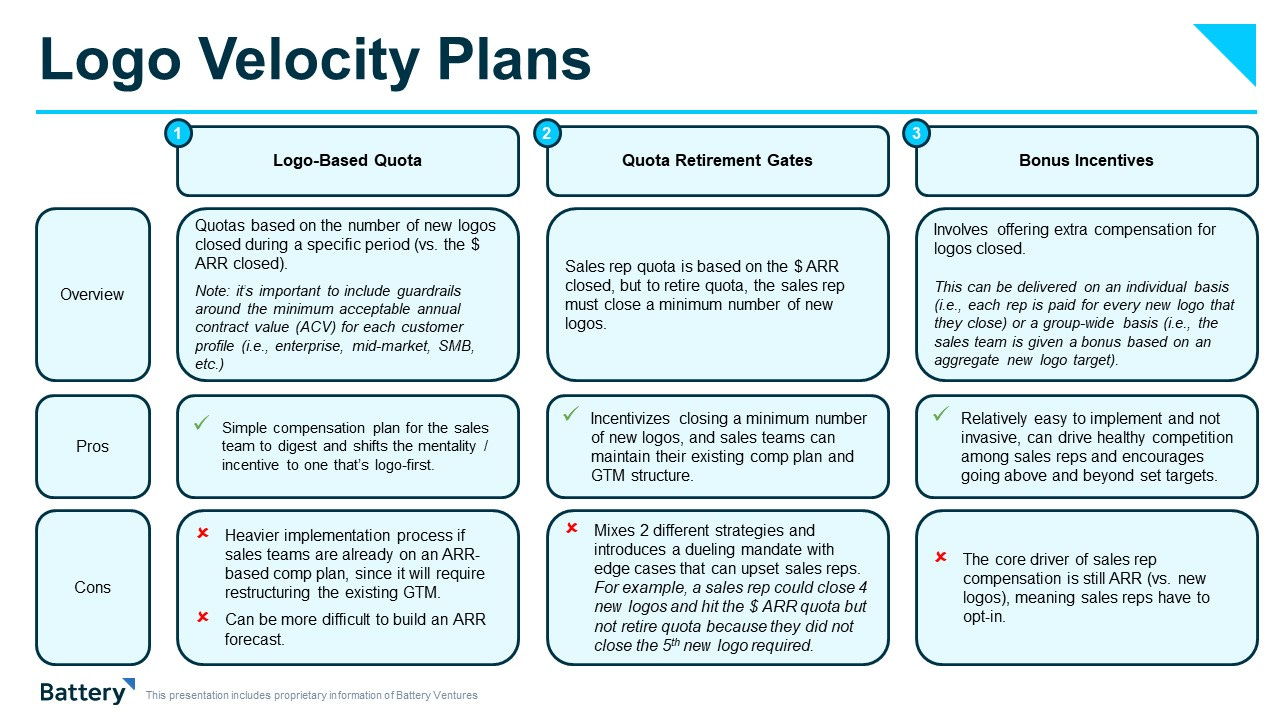

- Align compensation. The way you compensate your GTM team will dictate their behavior. Compensating sales reps solely on hitting an ARR target will incentivize them to focus on deal size rather than the number of new customers. But in this environment, landing a big deal has become less of a sure thing—and the opportunity cost of a slipped deal is high. Adjust your sales team compensation plan to incentivize new logo velocity. Below are a few ideas.

- Never compromise on your ideal customer profile (ICP), but your lands don’t need to reflect the value of your ACV. Don’t just sign any customer to get a deal done. Aim for high-quality customers who fit your ICP. If you’re targeting the right customer profile, smaller-land ACVs can be a great way to get new customers in the door quickly, prove value, and drive contract expansion over time. Depending on your pricing model, you can sign a great customer for a smaller number of seats or a subset of product features to keep the land-deal size manageable and ensure a fast time to close. Just make sure that you’re not cutting deal sizes too much and undermining the profitability of each new contract. As shown above, we suggest you think about instituting minimum deal sizes based on the customer profile (i.e. small, medium and large).

- Customer success matters. The logo-velocity playbook is intended to set you up for long-term growth, but it won’t work if you’re not prepared to nurture and expand the new customers that you’re signing. Time-to-value is critical, and it’s important that you have the right resources dedicated to onboarding customers, helping them find value quickly and then expanding them over time.

In summary, prioritizing logo velocity involves emphasizing the speed and volume of customer acquisitions over deal sizes. Especially in this complex economic climate, that prioritization can help software companies build the foundation to deliver repeatable and predictable growth.